[ad_1]

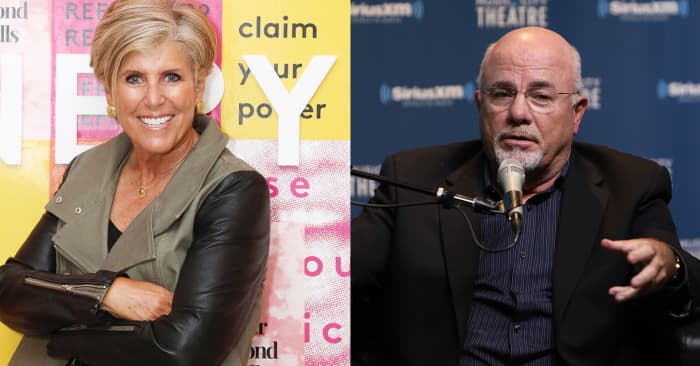

Experts such as Suze Orman and Dave Ramsey emphasize the importance of emergency funds. This helps prevent credit card debt.

Getty Images

American credit card debt rose to $887 billion in the second quarter of 2022, according to the Federal Reserve Bank of New York. And what was the number one reason they gave for this debt? It is said that the balance is maintained every month. New CreditCards.com report.

The solution to this is a tried-and-true rule followed by nearly every personal finance mogul. It’s about building an emergency fund. And there’s good news on that front — these savings accounts are paying out far more than they did last year.

Exactly how much you save varies from expert to expert, but a general rule is 3 to 12 months worth of expenses. Suze Orman has attended her 12-month camp and said: And I also know that I understand that it can take time. ” Dave Ramsey’s general rule of thumb is that people need 3 to 6 months of emergency savings. “The more stable your income and household, the less emergency funds you need,” says Ramsey. The goal is to soften the blow or fully cover an unexpected expense. (See the best savings account rates you can get here.)

| reasons for credit card debt | % person’s |

|

Cover for emergencies and unexpected expenses |

46% |

|

Daily expenses such as groceries, childcare, and utilities |

twenty four% |

|

Retail purchases such as clothing and electronics |

11% |

|

vacation and entertainment expenses |

11% |

NerdWallet credit card expert Melissa Lambarena recommends setting up at least $500 in emergency funds for the unexpected. “Even if you’re saving $5 a week. Once you’ve found your financial base, find a way out by choosing a balance transfer credit card like a shovel or a debt management plan at a nonprofit credit agency.” says Lambarena.

How to get out of credit card debt

-

Apply for a direct debit card with 0% interest

Rossman recommends signing up for a transfer card with a 0% balance. “These promotions will last for 21 months. The average credit card fee is 16.73%, and using a 0% balance transfer card can save you hundreds or thousands of dollars in interest, so this is a great deal for me. It’s our favorite debt repayment tactic,” said Ted Rossman, Senior Industry Analyst at CreditCards.com. (You can find some of the best 0% transfer cards here.) Successful use of a balance transfer credit card can significantly reduce the amount you pay over the life of your balance and speed the time it takes to get out of debt. LendingTree chief credit his analyst Matt Schulz said: That said, it’s important to pay off during the 0% period and avoid using the card to make new purchases as the interest rate will skyrocket once the promotion ends.

-

do the snowball method

One way to deal with credit card debt is to follow the snowball law. This is what Rothman suggests if you’re overwhelmed by the amount of debt you owe. “There are psychological benefits to paying off an account with the lowest balance, much like a rolling snowball gaining momentum,” he says. (Of course, always try to pay the minimum amount for all your debts.) By getting rid of your smallest debts first, you’ll feel like you’re making progress and will be more motivated to keep working. It may not make much sense mathematically, but it will help you start the process of paying off your debt. - credit card integration “You do that by taking out a new loan, such as a personal loan or a balance transfer credit card, and then using that one loan to pay off several other loans,” Schulz says. , can save you a lot of money on interest and can also simplify your finances as you only have to manage your payments with one loan. (See some of the best personal loans available here.)

How to control spending

Point Guy Content Director Nick Ewen recommends analyzing your total monthly income to speed up your spending. “Next, plan out all the essential items that you have to pay each month (housing, groceries, utilities). Finally, take a very critical look at your discretionary spending. Eliminate anything you don’t really need, like eating out with co-workers for lunch multiple times a week,” says Ewen.

Any advice, recommendations or rankings contained in this article are those of MarketWatch Picks and have not been reviewed or endorsed by our commercial partners.

[ad_2]

Source link