[ad_1]

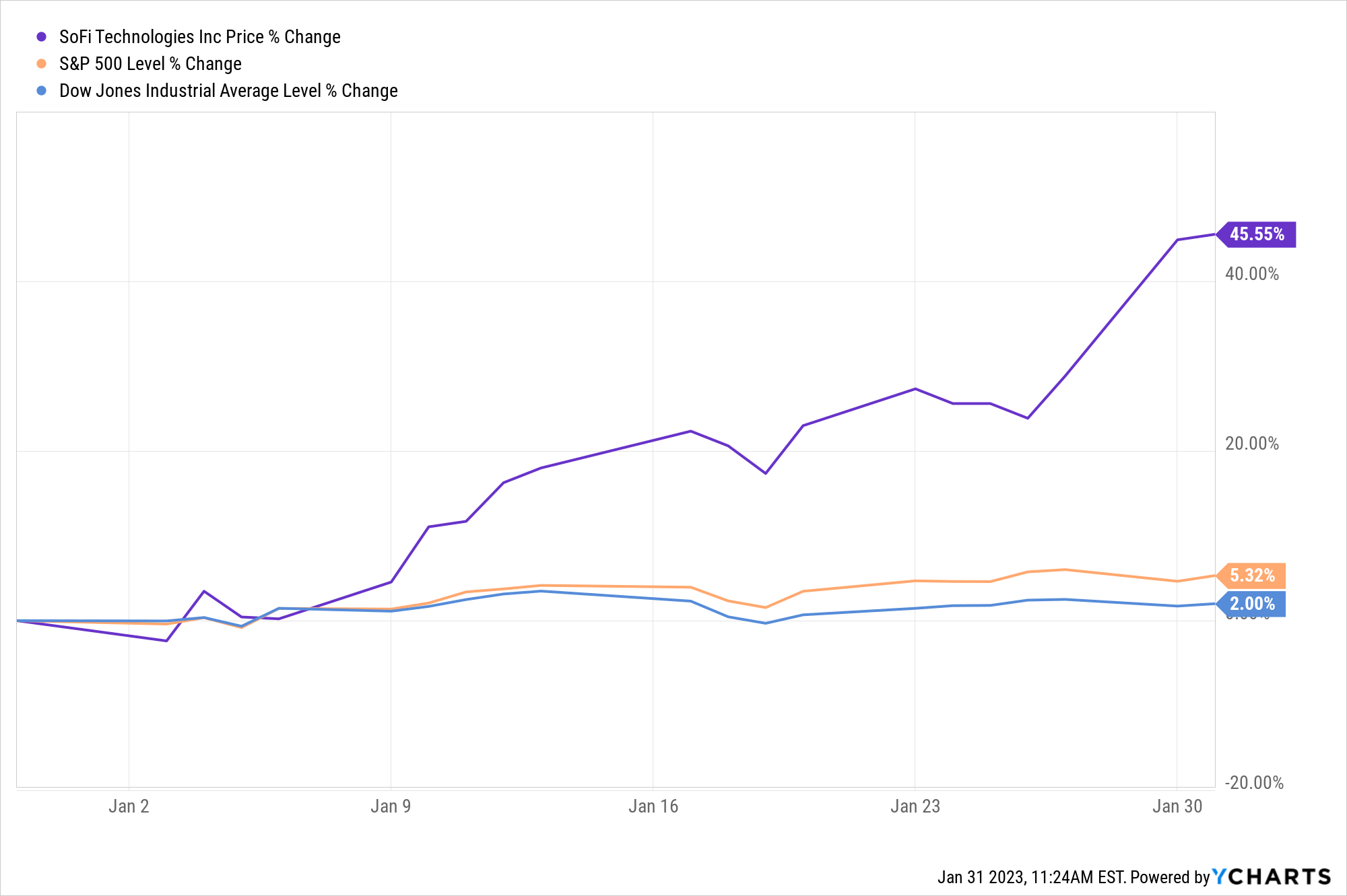

And just like that, my Top stocks to buy in 2023 It’s already up almost 50% this year.

Fintech company Sophie (SOFIMore) reported impressive fourth quarter numbers yesterday morning. The stock price he rose more than 12% even though the rest of the market fell. The big post-earnings rally continued what was a monster rally for his SOFI stock in 2023. Year-to-date, the stock is already up more than 45%, making him one of the hottest stocks on the market right now.

for perspective, S&P 500 is up about 5% this year, Dow Jones That’s just a 2% increase.

SOFI stock is now simply crushing it.

I think the rally in SOFI stock is just beginning. actually, I think stocks are just beginning a massive breakout.

quick review

SoFi is a personal finance app that is rewriting the rules of consumer finance. Forget physical banking. A new generation of digital native online banking made for the modern consumer, all through a single ‘super app’.Basically what SoFi is trying to do is bank of america (BACs) When wells fargo (WFCMore) what Amazon (AMZN) bottom JC Penney When Sears: use technology to make them extinct.

We believe the company is trying to do just that. SoFi is the future of banking. The emerging “financial Amazon,” as you say.

Still, SoFi was absolutely stock crushed In 2022, a myriad of factors are to blame, including rising interest rates, slowing lending activity and consumer spending, and a continued moratorium on student loans.

But as the old saying goes, It’s always darkest before dawn.

That’s why we were pounding at the SOFI stock table in late 2022. It felt like this future superstar was about to stage a huge breakout.

That breakout has arrived. I think now is the time for stock prices to rise.

Here’s why:

Banks suck, but SoFi solves the problem

Few people like traditional banking processes.

account fee. clearing house. high interest rate. Broken digital platform. Confusing reward program. Long phone calls and face-to-face appointments.the whole process is throw, highWhen CumbersomeThe main reason is that the industry is full of profit-seeking middlemen and rooted in outdated and costly physical processes.

So… what if technology automated these intermediary profit takers? What if you offered your solution to customers across the United States? Or even better, someone did it all and then put it in an app so you could control all your banking transactions from your phone?

That’s what SoFi does.

SoFi was founded in 2011 by Stanford Business School students who were fed up with the inefficiencies in the student loan industry. They saw great opportunities to fix these inefficiencies, and he recognized two causes.

Banking was a physical-first industry at the time, and was burdened with many real estate-related costs that were inevitably passed on to consumers.

Second, student loans were typically structured as a complex transaction with numerous intermediaries, who had their own fees that college students had to pay.

SoFi was created with the idea that a platform could leverage automated technology and digital native experiences to create incredibly convenient access to cheap student loan refinancing.

worked.

Over the past decade, students across America have refinanced their loans through SoFi, taking advantage of the low interest rates made possible by using technology to reduce the cost of running their businesses. (SoFi, of course, passes those cost savings on to its customers.)

that is”hero products” made SoFi a household name in the fintech world.

Since then, SoFi has leveraged this success story to build an ecosystem of high-quality, low-cost, and highly convenient fintech solutions. All these solutions are accessible from one intuitive “super app”.

Through the SoFi app, the company offers:

- Sophimoney: A cash management account that works like a mobile checking or savings account. There are no account fees, APY is 1% and comes with a debit card.

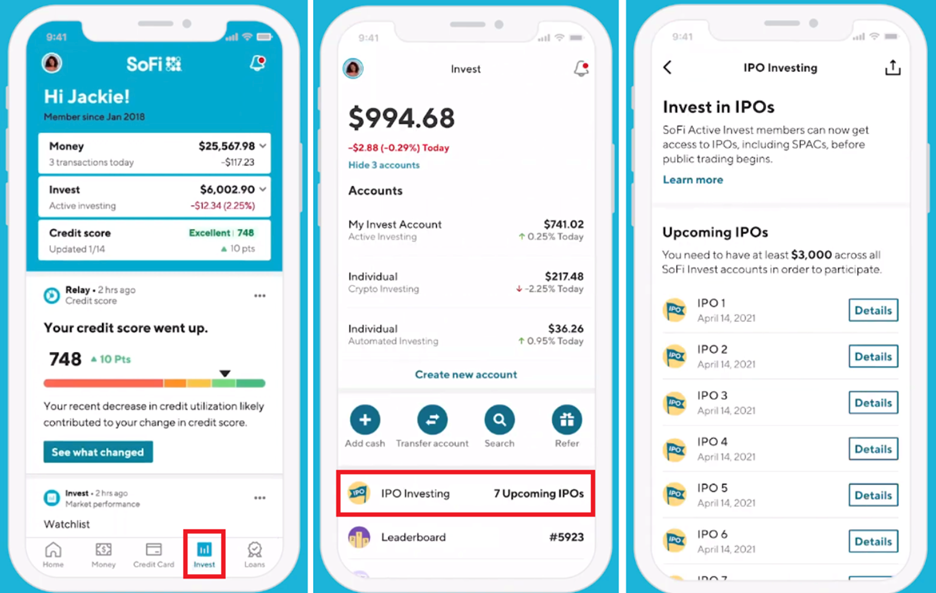

- SoFi investment: A connected mobile investment account. In it, consumers can use funds from SoFi Money to invest in stocks, ETFs, and cryptocurrencies. They can also invest in pre-IPO stocks that are typically reserved for institutional investors.

- SoFi credit card: Attached credit card. Consumers can link their Money account to this card to earn her 2% cashback on all purchases. These rewards can be used to pay off debt through SoFi Loans or invest in stocks/cryptocurrencies with SoFi Invest. Moreover, the annual fee is free.

- SoFi Relay: Included budgeting software tools. Consumers can use it to track and monitor their spending through their SoFi accounts and externally linked bank accounts. You can also check your credit score.

- SoFi Education: Supplemental educational articles and videos to help consumers learn all about finance. We cover topics ranging from how to invest in cryptocurrencies, to what APR is, to why your credit score matters.

With SoFi you get it all in one application.Its all-in-one mobile money app leverages technology to enable banking fast, It’s cheapWhen Simple.

It’s the future.

In 2022, investors forgot about that future. Now the market recognizes that the future of finance is up for sale – Everyone hurry up and buy some dip.

SoFi Earnings Show Perfect Execution

In 2022, everyone thought the combination of rising interest rates, declining lending activity, declining consumer spending, and moratorium on student loans would have a significant impact on SoFi’s business.

After all, if people weren’t spending, refinancing, or looking for loans, SoFi’s revenue stream would theoretically dry up quickly.

But they are not exhausted. Jeez. This speaks to the overall value proposition of the SoFi platform.

SoFi just reported its fourth quarter earnings on Monday. The numbers couldn’t be better. And they’re painting a picture of the company firing on all cylinders right now.

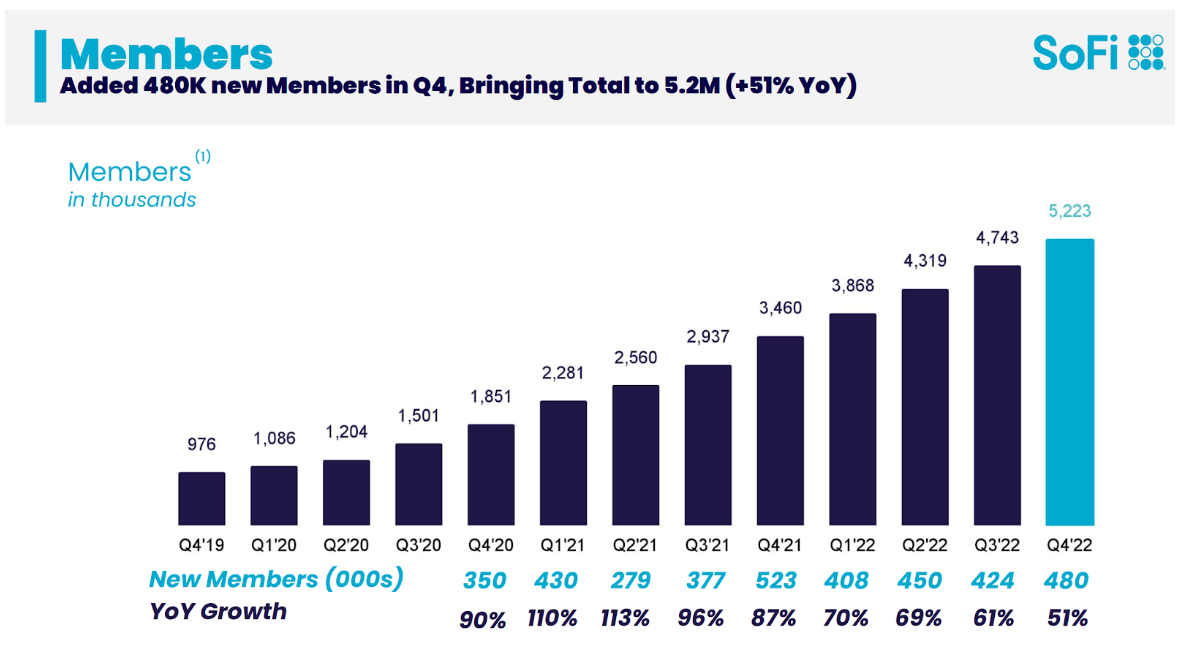

SoFi added 480,000 new members last quarter. This surpasses his 424,000 addition last quarter. This means that user growth is actually accelerating from an already impressive pace. Total membership increased by over 50% year-on-year.

Source: Sophie

Revenue increased 58% year-over-year, marking the third consecutive quarter of accelerating revenue growth. The EBITDA margin also hit his 16% mark, well above expectations and a staggering nearly 10x year-over-year growth.

Moreover, management has led all of this massive growth to continue into 2023, even given the risk of recession. The team believes his earnings will grow by more than 25% this year (above consensus estimates) and his EBITDA margin will increase by another 500 basis points (also above consensus estimates).

In other words…

Members, revenue and profit margins are all rising very quickly and well above expectations.

as i said, The report was great.

SOFI shares rose 13% in response. The stock is now up more than 45% year-to-date.

It’s a huge gathering. But we think it’s not over yet.

SoFi Stock: A Potential ‘Fortune Maker’

In the long term, we really think SOFI stocks are a “lucky” investment opportunity. In fact, it could rise many times over from current levels.

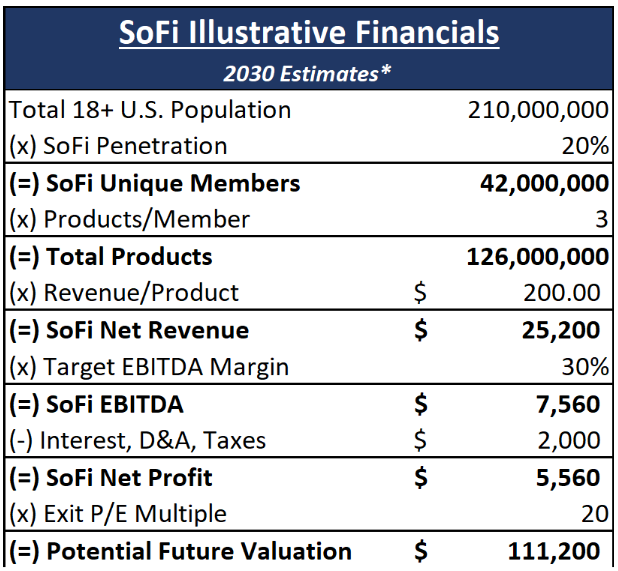

Here is the calculation on the back of the envelope.

There are currently approximately 210 million people in the United States aged 18 and over. About 20% of that he could be a SoFi member by 2030, which means that her SoFi member base will reach her 42 million.

Most users use about three products (banking, credit cards, and investments), meaning a total of 126 million products in use. We estimate that the average revenue per product at that point will be about $200. Assuming that, 2030 revenue would put him just over $25 billion.

A software-based business with such a competitive moat needs to grow towards a 30% EBITDA margin. Based on that assumption, we believe net income could exceed $5.5 billion by 2030.

Based on a simple 20x price/earnings ratio, SoFi’s 2030 valuation target is over $110 billion.

The current market capitalization is $5.4 billion.

In other words, We believe the stock could jump 20x for patient investors.

A short-term SoFi stock breakout is underway

However, SOFI stocks are not just for the patient investor.

I think the chart shows that we want the stock to go significantly higher in the short term as well.

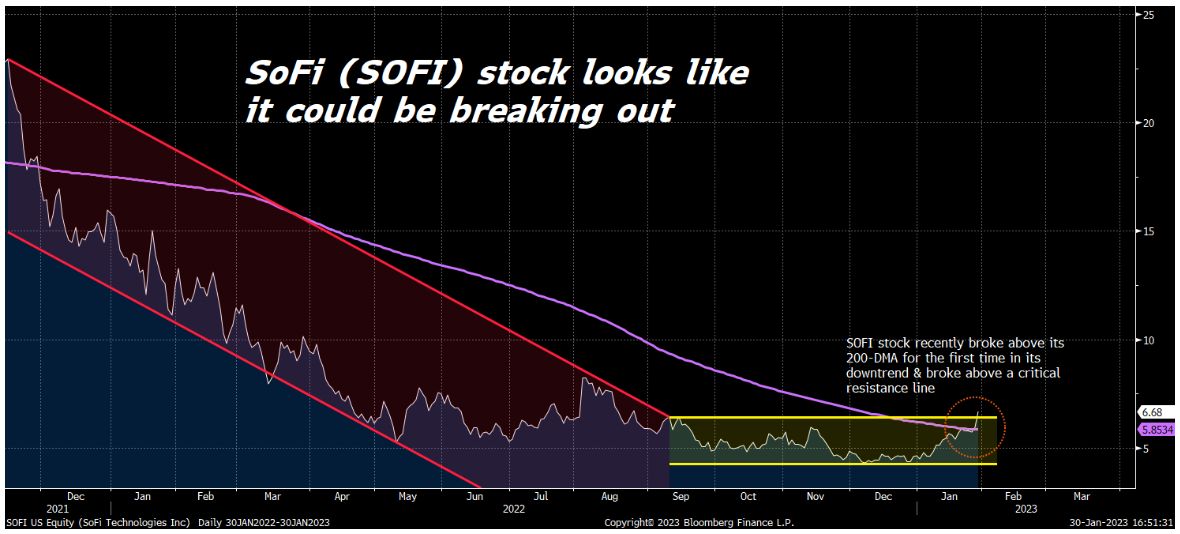

Looking at SOFI, we see stocks that were in a well-defined downtrend until around September 2022. It then started trading sideways in a correction pattern.

Yesterday’s big rally took the stock above its correction channel and above the key resistance cap. The stock has also regained his 200-day moving average line for the first time in this downtrend.

This trading action is consistent with stocks gearing up for a big short-term breakout.

Final Words on SoFi Stock

The nasty bear market of 2022 seems to want to turn into an exciting new bull market in 2023.

So now is a great time to invest. Stocks are the easiest way to build wealth when a bear market turns into a bull market.

Did you know that all of the stock market’s best short-term trades in the last 20 years happened when a bear market turned into a bull market? Late 2002, early 2009, early 2020. In each era, the S&P 500 has seen him soar more than 50% in less than a year.

Did you also know that dozens of stocks doubled in less than 12 months from late 2002 to early 2009 to early 2020?

The data here is so clear that, again, it sounds like a broken record. Stocks are the easiest way to build wealth when a bear market turns into a bull market.

We are in the midst of these generational shifts right now.

Already, the S&P 500 is up about 5% a month and is on track to achieve a return of 50% or more within 12 months.

Already, 109 stocks have more than doubled since the beginning of the year in less than a month.

A new bull market is emerging. Are you ready to take advantage of it?

Learn how to spot stocks like SOFI before they soar 50% in less than a month.

As of the date of publication, Luke Lango did not have any positions (directly or indirectly) in the securities referenced in this article.

[ad_2]

Source link