[ad_1]

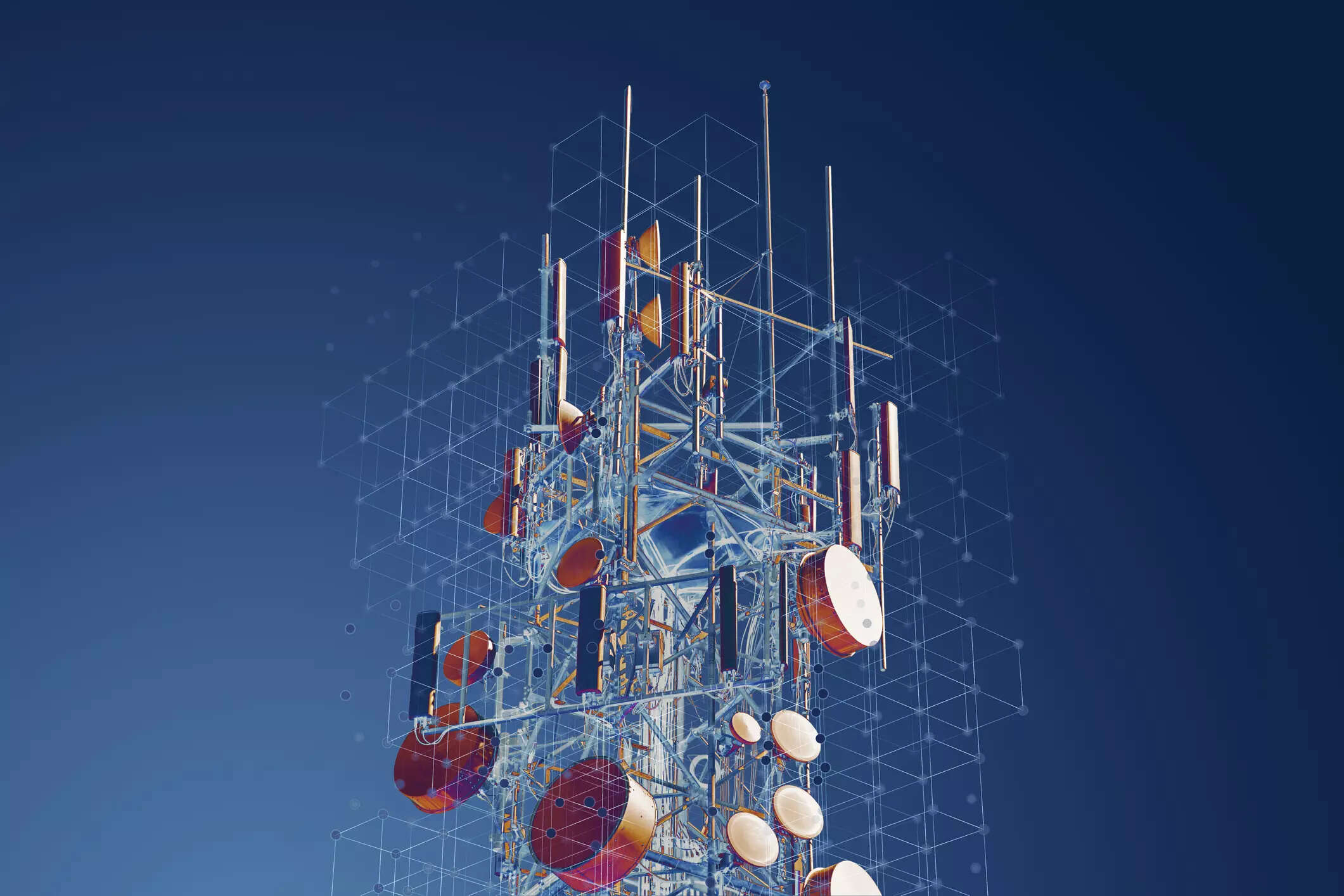

New Delhi: Low investment combined with lack of access to deploy infrastructure could negatively impact next-generation or 5G deployments in India.

With a huge debt of INR 60 crore, the telecom industry is lagging far behind the national goal of deploying telecom towers, fiber networks and backhaul fiberization. This will affect the smooth rollout of 5G across the country.

“Investment and infrastructure are the two main challenges to overcome for the successful pan-India rollout of 5G services,” SP Kochhar, Secretary General of the Association of Indian Mobile Operators (COAI), told ETTelecom. rice field. It is the main obstacle to fiberization and towerization.

Based in Delhi, COAI represents Reliance Jio, Bharti Airtel and Vodafone Idea.

Last year, the Department of Telecommunications (DoT) amended the RoW framework to work with states, local bodies and service providers to expedite permit tracking using a centralized Gati Shakti single-interface portal. set a mechanism.

Industry has applauded the center’s efforts, but localized issues in obtaining permits for tower construction and fiber deployment continue to undermine stakeholders.

At ground level, COAI’s Kochhar believes underground and aerial fiber deployments continue to be a bottleneck. This is because local organizations must follow state policies and local governments. “Unless local governments rapidly adopt the Central RoW regulation in letter and spirit, a faster rollout and deployment of 5G will not be possible.”

Ironically, carriers backed by infrastructure providers failed to meet the nationwide targets envisioned by the Center’s ambitious National Broadband Mission in 2019, significantly slowing next-generation network adoption. hindering.

Towersisation: a reality check

National targets include towers reaching cumulative INR 10 lakh and 12 lakh in 2022-23 and 2023-24 respectively, according to industry data provided by Digital Infrastructure Providers Association (Dipa) and only 739,000 telecom towers deployed. domestically so far.

That’s also when carriers come up with weekly strategies against the backdrop of aggressive 5G rollouts.

Telecom infrastructure group Dipa believes that setting up the underlying digital infrastructure to support the launch of 5G will require “significant investments” over the next five years.

Mahesh Uppal, Founder and Director of CommFirst India, believes the tower’s goal is unrealistic due to several regional issues, such as the involvement of multiple agencies that prevent the tower from being installed.

In addition to existing bottlenecks, operators are spending on regulation and licensing fees following the sale of 5G spectrum, despite government intervention to announce a series of reforms in line with ease of doing business. only added to the financial problems.

ICRA Vice President and Sector Head Ankit Jain said, “After the auction, the industry debt level will further increase to around Rs 6 billion as of March 31, 2023.” Stated.

Carriers face an inevitable burden when it comes to capital expenditures required to deploy and expand their 5G networks.

A Delhi-based credit rating agency estimates that annual installments of spectrum payments will be rupees. It will snowball to 1,336.5 billion rupees in 2023, 19,600 rupees in 2024, and 65,500 rupees after 2026.

According to a recent E&Y and Dipa study, the industry will require a cumulative investment of Rs. It includes various building blocks of 5G, including in-house solutions.

“Businesses face high costs as they look to deploy 5G and expand 4G. Progress has been made on the RoW front, but local challenges remain beyond government control.” Because the land is subject to the state and some private interests are also involved.” Added CommFirst’s Uppal.

Fiberization: A Missed Target

The national mission also intends to increase backhaul fiber coverage, which is essential for 5G rollouts, from 35% today to 65% in 2023-24, but this also seems far from reality.

According to recent Crisil Research findings, the current low level of fiberization will require network capital investment of INR 150-250 crore in the next 2-3 years.

“The lack of adequate backhaul at a reasonable cost presents a significant deployment challenge,” said Kocher, noting that permission from the Residential Welfare Association will allow self-regulation and compliance with its own set of rules. It is still a tumultuous challenge, he added, because it is not being done. Existing centralized policy.

Most states do not map street furniture GIS data through the Gati Shakti portal. The lack of clear explanations from local governments has slowed the adoption of the online mechanism, while the annual fee for obtaining permits on government land remains high,” Dipa said.

Ashish D Jain, Executive President and Chief Operating Officer, Telecom Business, said: Polycab India added that his lack of a speedy RoW mechanism is hampering fiber deployment in the country.

India’s fiber coverage per capita is currently only 0.09.

Jain said that approvals from multiple authorities or agencies are currently required and a single point of contact approval for the RoW regulation will go a long way in carrying out fiber rollouts in a quick and smooth manner. rice field.

Polycab’s CEO added that fiber connectivity needs to reach at least 70% by the end of 2024 to unlock the full potential of 5G-based services.

The National Broadband Mission envisions deploying up to 5 million kilometers of fiber optic cable by 2024.

read more:

[ad_2]

Source link